On May 24, 2007, I wrote an article titled: Are We Nearing a Top

In that article, I said:

“I am not sure if this WSJ article will signal a top but I tend to agree with Barry that this type of front page coverage has a history of signaling things to come.”

“…keep an eye on this performance chart to make sure the up-trend doesn’t extend too far without a natural pullback”

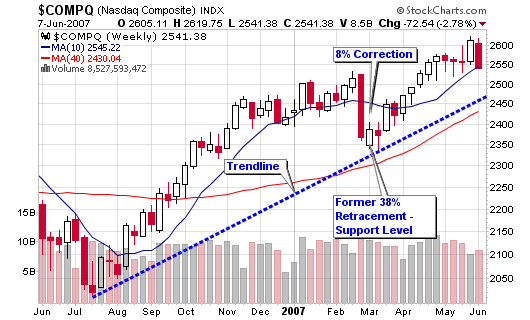

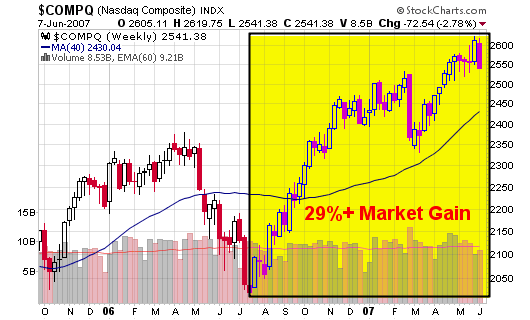

“The second chart shows the NASDAQ reaching a 28% gain over a year ago which has signaled tops in the past. Eugene D. Brody, from Oppenheimer Capital, was quoted as saying: “Sell stocks whenever the market is 30% higher over a year ago”.”

So, what can we make of the market over the past several days?

- First, the market looks to be making a natural intermediate correction which has been overdue in my personal opinion (remember, the action in the market is only a belief in your own mind).

- Second, the markets are extended (up 25%+) when compared to their levels from last year and I have been highlighting this fact over the past several weeks. Corrections are due when markets move up by 30% over their levels from the prior year.

- Finally, the markets can’t continue to trade too far above their 50-d and 200-d moving averages without making a pullback, even if it only last a few days to a couple weeks. They can continue to trend higher but pullbacks are a must in order to achieve sustainability. Welcome pullbacks and add shares in ideal situations.

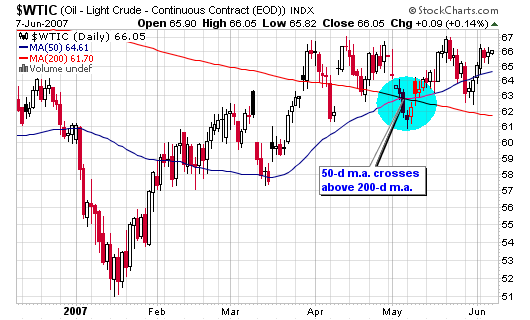

If you follow my annotated charts over on stockcharts.com, you may have noticed the fact that the 50-day moving average for crude oil has recently crossed above the longer term 200-day moving average (a sign that oil prices may push higher). The 200-d moving average is still facing south but things are starting to look better which usually means that stocks “as a whole” may be poised to take a breather or actually trade lower.

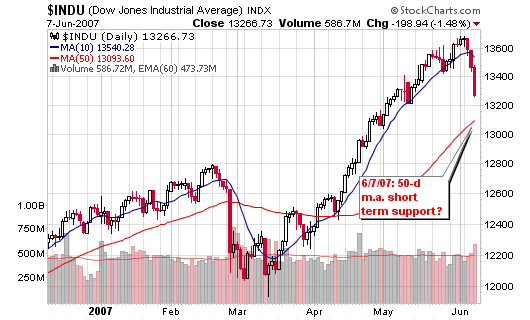

Let’s take a look at several charts:

The NASDAQ is now trading a few points above its 50-d moving average and has not traded below this line since its last correction in late February 2007. That correction was short lived but did give back 8% in gains as this week’s losses have totaled less than half of that.

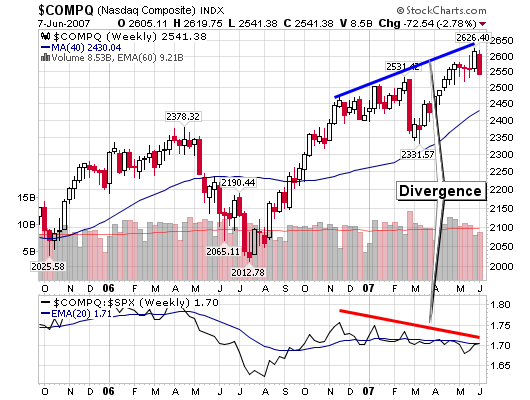

I did miss one BIG signal that highlighted a weak market over the past several months: a bearish divergence between the NASDAQ and its relative strength versus the S&P 500. As the index moved higher, the relative strength drifted lower; not a very promising occurrence.

The DOW was down about 3% for the week on above average volume which gives us pure distribution. Looking at the point and figure chart, I see one support level near 13,200 and then a possible free-fall towards 12,800 or 12,750 when overlaying the weekly candlesticks. The 200-day moving average sits near 12,400, an area I would rather not visit at this time.

Do I think the up-trend is over?

It doesn’t really matter what I think when you can follow the indicators above. However, I’ll give you my beliefs: The up-trend is making a natural correction and Wall Street analysts and newspapers are freaking. Corrections such as this are welcomed as they allow investors to accumulate shares in the top candidates before they resume their runs.

Very strong upside move today. A little too strong. I’d have liked to see some capitulation before going long. Monday will be interesting.

Do you think it would be a good idea to now buy ETFs that short stocks?

That daily chart on the dow shows THREE BLACK CROWS candlestick pattern. That would suggest strong resistance above the first candle of the three crow pattern. So markets may rally back up there, but be aware that there is signifigant resistance there and overall the pattern is short term bearish. I wouldn’t be surprised to see the Dow put in a correction.

Nice summary Chris. The 25% rule is a good ‘un – couldn’t be simpler.

Best wishes,

DJF

Hi Chris,

Now it is my turn to pay a tribute. 🙂

I couldn’t agree with you more. Trends will not change is a sudden, but ratter in slow pace.

Here in Brazil we call these freaking trades “sardine” and we say they always end up fried up in hot oil by changing their minds every minute based on the last news.

Just one thing a lot of people seen to forget is to always have some cash ready on the sidelines in order to really take advantage of the oportunities given by the corrections.

It require some boldness to buy them, but it has paid it for on the last ocurrences.

[]’s

DrFox