The title of the post is borrowed from the book “How to make Money Selling Stocks Short” by William J. O’Neil. It’s an ideal book for investors that focus on trading longer term trends and don’t necessarily do this for a profession (i.e.: day traders).

The book contains some excellent strategies for finding prime shorting candidates or stocks that are about to enter a declining stage that may offer excellent risk/reward setups for buying put options.

I consider several of the techniques in the book to be a reverse of the popular trading system? Study the charts from the past that have setup ideal shorts and then screen for those same characteristics in stocks trading today. Many of the ideal shorts from past market declines have held the reverse characteristics of an ideal “popular system” stock (that you would want to buy).

Many traders believe that the most obvious area to place a short would be near the peak of stock’s trading range but studies have found this to be untrue.

Characteristics of Longer Term Trend Shorts

- Most ideal longer term “trend” shorts take four to twelve months after the peak price to setup on the weekly chart with the majority of these shorts triggering between six to nine months.

- Look for stocks that had prior up-trends and support levels that can now act as downward resistance or entry areas.

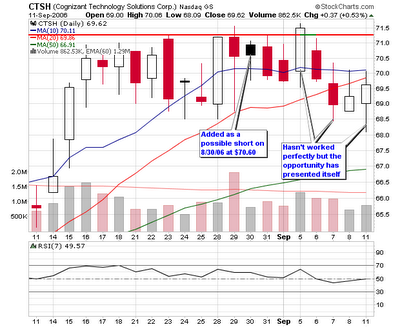

- Once a stock tops and starts to consolidate, you want it to slice through the 50-d moving average and then the 200-d moving average.

- A crossover between the 50-d m.a. and the 200-d m.a. is ideal and is graphically presented on each chart in this post

- The odds of success increase with each failed attempt for the stock price to recover these major long term moving averages.

- Head and shoulder tops can also serve as ideal setups for potential shorts if they take at least five months to develop.

- A decreasing relative strength line and a negative pattern on the point and figure chart can also confirm that the stock is rolling over and setting up an ideal short.

- Finally, volume should be increasing and the stock should be under distribution as it violates the major moving averages and starts to break former support levels.

Connect with Me