This list predominately focuses on younger stocks that have IPO’d within the past year or two. In addition to focusing on younger stocks, I focused on companies that are growing sales by at least double digits, preferably 25%+ QoQ.

I did not include any of the stocks listed from my annual “Stocks to Watch in 2019” nor did I list more established stocks that have been trading on the market for years (including holdings already in my account).

I wanted to develop a fresh list of potential opportunities that I could add to the portfolio (as of 7/29/19, I do not own any of the stocks listed below, with the exception of UBER).

With that said, traders and investors must be prudent when establishing positions by paying careful attention to the overall market health (is the market extended), the stock performance itself (is the individual stock extended) and the valuation of the stock (several listed have high valuations which do concern me short term).

-

ZM – $96.47: Zoom Video Communications, Inc.

The stock, which provides remote conferencing services using cloud computing, IPO’d in April and quickly traded from $60 to above $100 within 6 weeks. I’m not comfortable with the pricey valuation of the stock but I use and believe in the product. It’s everywhere I conduct business: clients, consultants, vendors, manufacturers, etc.

The 50-day moving average (50d ma) formed as of July and the stock is trading above it over the course of the month. Valuation aside, an ideal accumulation area is near this moving average ($90.91 as of 7/29/19).

Sales have increased from $30.9MM in July 2017 to $122.0MM in April 2019, an average change of 145% over the past 8 quarters.

Earnings have been positive the past 4 quarters but only by a few cents.

The stock is worth a position with a tight leash due to that high valuation.

-

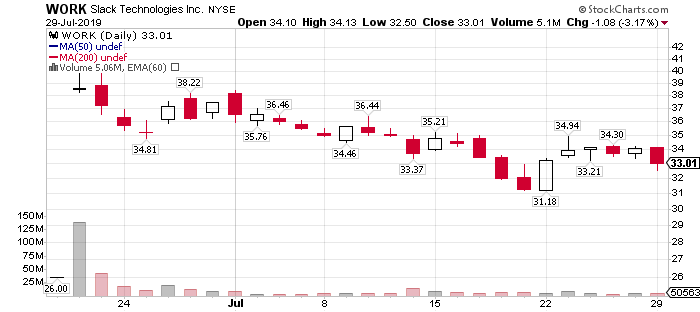

WORK – $33.01: Slack Technologies Inc.

The stock, offering a cloud-based set of proprietary team collaboration software tools and online services, debuted in June and has struggled as the price is down about 20% from the peak on its first day of trading.

Sales have increased from $51.3MM in July 2017 to $134.8MM in April 2019 for an average quarterly gain of 96% (this figured has dropped from 160% in Jan 2018 to 67% in the latest reporting period). Note that earnings are still negative at -0.07 in the latest quarter.

Considering the stock is still so young, it’s difficult to identify an ideal entry area without knowing how far it can fall before establishing a base. With that said, I like the technology so one could grab shares here and hold longer term.

-

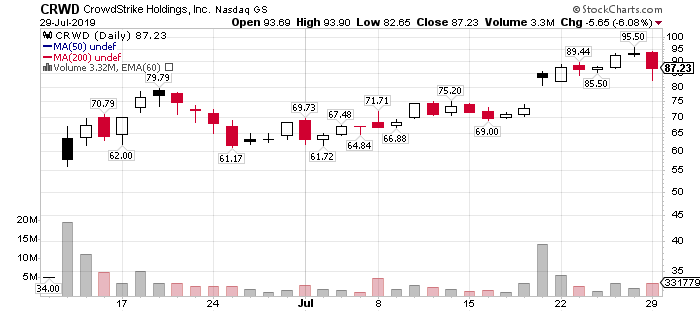

CRWD – $87.23: CrowdStrike Holdings, Inc.

Another young stock, debuting in June 2019, coming from a hot cyber security sector (provides endpoint security, threat intelligence, and cyberattack response services), competing against companies such as PANW, CYBR and OKTA. Okta has been one of the best performers from the first half of 2019 in my Stocks to Watch (+120.27% as of 7/27/19).

Sales have increased from $26.7MM in July 2017 to $96.1MM in April 2019 for an average quarterly gain of 118%. Earnings are still negative and are estimated to stay that way for at least the next two years.

Similar to several others on this list, the stock is too new to establish an ideal technical entry point so if you believe in cyber security, you can start to accumulate shares on any pullback on lighter volume. Keep an eye on the gap-up that took place July 18th to July 19th when the stock gained 14% from $72 to $83. Gaps don’t always close prior to major runs but I prefer them to.

-

SE – $36.73: Sea Ltd.

A young Singapore based company that specializes in wireless and wired digital entertainment and e-commerce platforms.

Sales have increased from $101.6MM in June 2017 to $351.9MM in March 2019 for an average quarterly gain of 72%. Note that sales have accelerated during the past four quarters for an average gain of 113%. Earnings are still negative and are estimated to stay that way for at least the next two years. The number of institutions owning the stock has nearly doubled in a year but remains relatively low compared to high growth stocks (plenty of room for accumulation).

The stock has more than tripled since the December lows and is well above the 50d and 200d ma’s so I suggest accumulation to wait for a healthy pullback, meaning a drop on lighter volume. The 50d ma would be the first area of accumulation as the 200d is $16 lower than the trading price. Maintain tight stops if you accumulate as the stock rises, well above the moving averages.

-

ESTC – $100.38: Elastic NV

I posted the following tweets regarding ESTC in April and May (a search company that builds self-managed and SaaS offerings for search, logging, security, and analytics use cases):

4/24/19: “$ESTC $85.95 has been making my screens for the past week or so. On watch as it looks ready to move back towards $100 building right side of base. Sales growing an ave of 78% QoQ past 7 qtrs.”

5/09/19: “$ESTC $85.43, building a quiet 10 week base before possible move back towards $100 and beyond. One could grab shares here just above 50d ma.”

Well, the stock broke out of the flat base and is now trading above $100. The stock hit a low of $72 on June 26th and has since gain $30 over the past four weeks on healthy volume. It’s a bit extended now so watch for any pullback on lighter volume, back to the 20d or 50d moving averages. We can also watch to see if the triple digit threshold can act as support for a possible entry area.

Sales have increased from $31.6MM in July 2017 to $80.6MM in April 2019 for an average quarterly gain of 76%. Earnings are still negative and are estimated to stay that way for at least the next two years.

-

DOCU – $53.90: Docusign, Inc

The company provides e-signatures that allows businesses to digitally prepare, execute and act on agreements. Being in the real estate industry (design and construction), we are constantly drafting, reviewing and executing contracts and I can tell you that the majority of folks are using this solution.

Sales have increased from $125.5MM in July 2017 to $214.0MM in April 2019 for an average quarterly gain of 36%. Earnings turned positive in the January 2018 quarter and have maintained this territory since, with a $0.07 EPS in April 2019. Estimated annual EPS is projected to go from $-0.18 in 2018 to $0.38 in 2021.

The stock has been forming a base the past five months since peaking at $59.62 in March 2019. An investor can accumulate now if they believe in the business. Ideal entry points are near the 50d and 200d moving averages.

-

ZS – $85.57: Zscaler, Inc.

Zscaler operates in the global cloud security sector so it also competes against PANW CYBR OKTA and CRWD. I have liked this sector for several years now and don’t believe it’s going away anytime soon.

Sales have increased from $36.5MM in July 2017 to $79.1MM in April 2019 for an average quarterly gain of 56%. Earnings crossed from negative in July 2018 to positive in October 2018 and have remained there since. Estimated annual EPS is projected to go from $-0.20 in 2018 to $0.19 in 2020. The number of institutions owning the stock has doubled over the past 18 months.

I started to tweet about Zscaler in February 2019, as it was making screens on a consistent basis. I profiled the chart in March saying:

“$ZS + 71% YTD. Exploded in March but the gap-up always concerns me. Ideally, I’d like to see that close, which could provide entry near 200d”

Well, the gap didn’t close, which I noted doesn’t always happen when a stock wants to run. I didn’t by ZS and it has since gone from $67 to as high as $89. The stock is up 110% year to date and is currently extended from an ideal entry point but keep an eye on it for any healthy pullback to a support area of major moving average. The 50d ma has been a nice accumulation area over the past several months, providing 4 opportunities to enter.

-

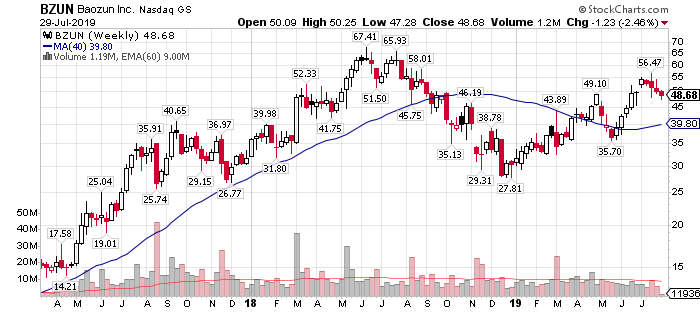

BZUN – $48.68: Baozun Inc.

The stock, which is a famous brand E-commerce business partner, and a leading digital technology and solution company in China, has been building a cup shaped base over the past 12 months after reaching a high of $67.41 in June 2018. It corrected to a low of $27.81 in the market lows of December 2018, followed by the right side of the base in 2019.

Sales have been increasing an average of 27% QoQ over the past two years while earnings are positive, between $0.09 and $0.50.

The ideal accumulation area is closer to the 50d and 200d moving averages. The month of May provided investors with an ideal opportunity in the 30’s (at the 200d ma) so let’s keep an eye on another possible setup. The stock appears to be pulling back nicely over the past four weeks.

-

GBTC – $12.16: Grayscale Bitcoin Trust

The GBTC shares track the Bitcoin market price (based on Bitcoin per Share), less fees and expenses. Each share represents ownership of approximately 0.092 bitcoin, an amount that will decrease over time as management fees are charged to the fund. It’s not a 1-to-1 correlation to the actual price of Bitcoin so that’s why I recommend investors to buy Bitcoin direct rather than have profits eroded with this vehicle.

With that said, it’s an alternative to trade Bitcoin if you don’t want to buy the crypto currency direct and trade it easily in your stock account. Gemini or Coinbase are the exchanges to buy direct (I currently own Bitcoin through each exchange but have been growing greater confidence in Gemini).

GBTC has traded back down to its 50d ma (just below) over the past several days which could be a short term buy area. I wouldn’t be surprised if Bitcoin and GBTC corrected back (closer) to their respective 200d ma’s, which currently sits at $7.25. The $9 area is not out of the question and would be an ideal level to accumulate for a trade ($8,000’s for the actual crypto currency).

This is a speculative Bitcoin play without buying the actual crypto currency.

-

DOYU – $10.50: DouYu International Holdings, Ltd.

The stock, a Chinese video-game live-streaming platform, debuted two weeks ago and is a direct competitor of HUYA, a stock I currently own.

Sales have increased from $54.7MM in June 2017 to $221.6MM in March 2019 for an average quarterly gain of 135% (amazing, if accurate). Earnings went positive for the first time in the March 2019 reporting period, at $0.02.

Similar to WORK, the stock is too new to establish a technical entry point so if you believe in live streaming games & entertainment and the size of the Chinese market, grab shares here and hold for the longer term.

Other interesting young stocks to watch as well:

- PINS

- PAYS

- UBER

- LYFT

- YETI

Previous Stock Trends Lists:

January 1, 2019: Stock to Watch in 2019

January 1, 2018: Stock Trends for 2018

My Wife’s Mutual Fund:

Original Post:

August 6, 2014: My Wife’s Personal Mutual Fund Outperforms the ProsFollow-ups:

February 21, 2016: My Wife’s Personal Mutual Fund Crushes the Markets, AGAINAugust 7, 2016: My Wife’s Buy & Hold Strategy Still Crushing the Professionals

November 19, 2017: The Wife’s Stocks Outperforming 3 Years Later

Speak Your Mind