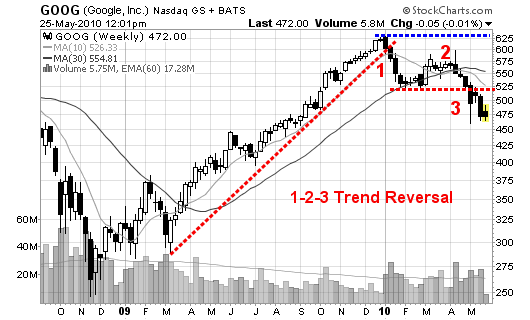

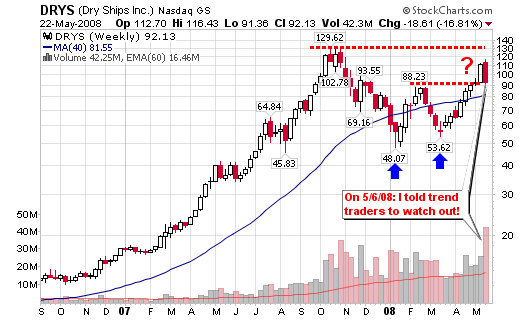

Google (GOOG) has setup the Trader Vic 1-2-3 pattern or a Dow Theory confirmation of a trend change.

As you can see:

- GOOG broke the up-trend after establishing a new 52-week high above $629 (point #1).

- From there, it consolidated and formed what is referred to as the minor sell-off (the lower horizontal red dotted line).

- Prices started to rise but failed to make another new high. This test of the previous high failed near point number 2 (March & April).

- A failure to make a new high is usually (not always) a signal that the trend is about to change. This is where some traders jump in early.

- Lastly, we reach point number 3 where prices drop below the previous short term minor sell-off (this is trend reversal and the signal to short). If missed, you can short on the first failure to recover the major moving averages (or #3 area which then turns to resistance).

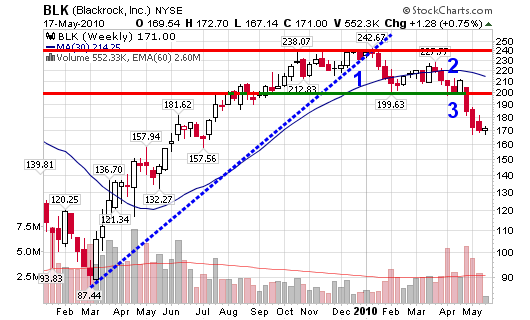

This is the pattern I am watching setup in dozens of stocks across multiple industries. I am also watching this pattern to potentially setup in the major indices as well.

Remember, have patience and be prepared to sit on the sidelines for a while as this pattern takes time to build and then confirm (4 months for GOOG). The key word is CONFIRMATION!

You may play GOOG up and down short term but long term, the trend has changed!

Follow me on twitter to watch the stocks currently setting up this pattern (prior to confirmation).

Connect with Me