The New High � New Low ratio (NH-NL) had its highest average number of new highs last week with a final tally of 541-55. It was only the fifth week of the year that had new highs average 500 or more stocks per day. It was also the highest new highs weekly average since the spring of 2005 (prior to me publishing the breakdown with the NH-NL chart). Daily new highs topped 613, 756 and 620 during the middle of last week for the best three day run of 2006 with Wednesday, November 15, 2006 giving us the strongest one day total since Wednesday, April 19, 2006 when the ratio finished at 759-61.

That was the second strongest week of the year with an average ratio of 540-75, just one new high per day less than this past week (new lows averaged 20 less last week than they did during that week in April). Even though the market averaged more than 500 new highs per day, the weakest total came on Friday as new highs dropped considerably as you can see in the table below:

New Highs vs. New Lows – Daily Breakdown, 11/13/06-11/17/06:

Monday showed a ratio of 423-59

Tuesday showed a ratio of 613-71

Wednesday showed a ratio of 756-58

Thursday showed a ratio of 620-40

Friday showed a ratio of 291-46

The accompanying chart shows us the up-trending fashion of new highs on the NASDAQ over the past six months. June and July were very sloppy with mixed results as separation became very clear in mid-August as new highs accelerated their advance while new lows decreased considerably and maintained a low profile.

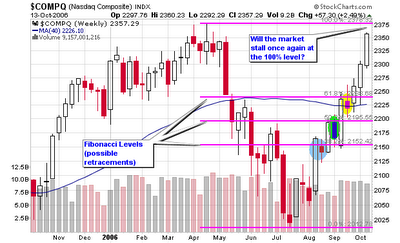

The NASDAQ completed the 100% retracement that I have been following since August here on the blog and has blasted higher on above average volume. As you can see, the index stalled briefly at each retracement level before moving higher and did so in perfect Fibonacci fashion. I am not a complete Fibonacci buff but I do watch for these levels as they seem to apply in longer term weekly charts more often than not.

Viewing the daily chart, we can see that the NASDAQ is still trending above the support line that dates back to early August with one slight violation earlier this month. I thought that was the trend reversal but the market quickly proved me wrong and forced me to cover a couple short positions. I also covered a few long positions that actually went higher but I can�t complain because getting out on top is not the objective when trading. Trading the signals and making a profit is my sole objective (picking bottoms and tops are great for blog stories but don�t translate well to portfolios � at least not mine).

The number of stocks trading above their 50-d moving average in the chart titled $SPXA50R is flirting around the extended area of 80 for the first time since November and December of last year. The lesson we can learn here is the fact that the market didn�t roll over until May of 2006 which means that this secondary indicator is a warning of what may come in the future. I can say this with confidence because the indicator also bottomed a full month in advance of the NASDAQ bottom in July but predicted the move perfectly. Again, this is only a secondary indicator but we are now one month removed from the first peak above the 80% level which could be the start of the warning bells and red flags that the up-trend is winding down. The last topping warning took almost five months to materialize so keep that in mind.

Another of the interesting secondary indicators we have been following on this blog is the relationship between large cap and small cap stocks. Small caps have been beating up larger caps in terms of performance since June 2000 with a few slight down trends from time to time. This was a year where large caps took the lead and were outperforming their smaller cap peers until the past two months. Small caps started to gain strength heading into the election and bounced off of the imaginary trendline on the chart below and have started to catch up in gains with their large cap friends. Many of these smaller cap growth stocks can capture sizable gains in shorter periods of time versus their large cap peers and this is why the overall trend has been higher for the greater part of this century. I wrote about the strength among large caps several times this year but I am firmly invested in smaller cap companies such as the ones listed on the MSW Index.

Some of the recent top performers from the MSW Index are listed below. As you can see from the numbers posted at the end of the day last Friday, the NASDAQ is quickly catching up to the performance of the DOW and S&P 500 in 2006. The NASDAQ was once down about 10% for the year and is now up over 10% and only 5% behind the DOW. How quickly things can change.

Where do the Major Indexes stand in 2006?

NASDAQ: +10.91%

DOW: +15.16%

NYSE: +14.74%

S&P 500: +12.25%

Top Performing MSW Index Stocks last week:

ICE: 18.90%

LRCX: 8.46%

ISE: 5.09%

LVS: 3.91%

JLL: 3.39%

GILD: 3.10%

AB: 2.28%

Here are the total gains of the current crop of MSW Longs:

LRCX: 19.88%, since 9/30/06

BLKB: 34.52%, since 8/5/06

LVS: 59.99%, since 4/1/06

GILD: 11.12%, since 7/29/06

ICE: 37.33%, since 9/23/06

EZPW: 29.39%, since 6/24/06

AB: 16.23%, since 7/29/06

ISE: 17.31%, since 8/19/06

JLL: 9.29%, since 9/9/06

NEU: 32.66%, since 7/29/06

DIOD: -5.75%, since 10/21/06 *currently the only down stock among longs

*11 Stocks (longs) have been cut for slight gains and/or small losses over the past couple of months which gives the index a 56% win-loss ratio in 2006. Twelve short candidates live on the MSW Index with two of them recently covered for losses.

Piranha

Connect with Me