The four stocks highlighted today are all trading slightly above their 200-day moving average after making some type of a correction over the past couple of months. I call them late opportunities because they were correcting when the majority of the market leaders were making new highs. This type of action could allow us to label them as laggards but their overall weekly charts would suggest otherwise.

They have all managed to trade above their long term 200-d moving average while showing us a history of success. It may be my belief and your belief that the market is near a top but do we really know when the market will officially top and start to trend lower.

I don’t think so!

So, take the trades since they have ideal risk-to-reward setups. What is the worst that can happen? You sell for a small loss. Big deal because this has been one profitable year so take the trade! These stocks aren’t the market leaders but you may be able to squeeze some profits out of the current moving average setups. We’ll call them lazy summer buys.

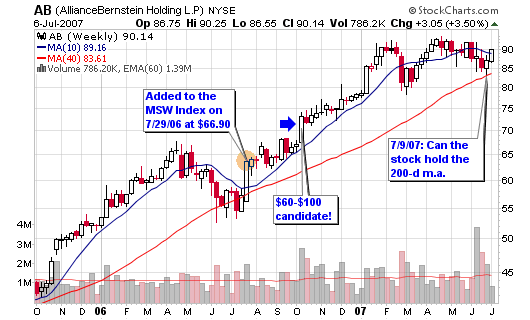

AllianceBernstein (AB) was one of the more consistent performing stocks on the MSW Index prior to me shutting down the index in March. The stock was screened heavily last summer and I started coverage on the 29th of July, 2006 at $66.90. The stock gained as much as 40% while on the index but has recently traded slightly downward as it makes a correction towards the 200-d m.a. It tested the line last summer and that is when I saw an ideal buying opportunity so I am now looking for a similar situation. It held the long term moving average as support last week so I would not have a problem taking a position.

(AB) Potential Trade Set-up:

Ideal Entry: $84 to $86 (currently $90.14)

Risk is set at 1.0% maximum of total portfolio or $1,000 of $100k

Stop Loss is 9% or $82.03

Number of Shares: 123

Position Size is $11,112

Risk is $8.11

Target is $108

Risk-to-Reward is 2-to-1

***The ideal entry would be near $84 for a risk to reward of 7-to-1. The stop loss would be 3% or $81.48 with a stop of $2.52.

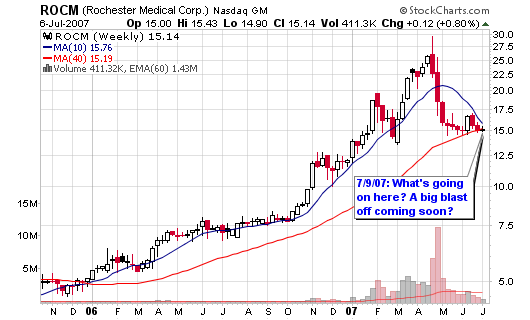

Rochester Medical (ROCM) has had one heck of a year as it blasted higher from $7.50 to as high as $29 in six months of time. Since the peak, the stock has corrected by 50% over the past two months and is now trading with a suspicious quietness above the 200-d moving average. Is there some type of news that will be released that will propel this stock higher? I don’t know but the trade setup is ideal so take it. Something may be going on behind the scenes so take the nice risk-to-reward setup.

(ROCM) Potential Trade Set-up:

Ideal Entry: $15 (currently $15.14)

Risk is set at 1.0% maximum of total portfolio or $1,000 of $100k

Stop Loss is 5% or $14.25

Number of Shares: 1,333

Position Size is $20,000

Risk is $0.75

Target is $21

Risk-to-Reward is 8-to-1

Click through to see the ideal trade setups for CHINA and GMKT:

[Read more…]

Connect with Me