Why do investors buy low priced stocks, thinking they can double quicker than a stock priced over $100?

Why do investors buy low priced stocks, thinking they can double quicker than a stock priced over $100?

Over the past three months, Tenaris (TS) has gained 46% even though it is priced over the triple digit threshold. It is up almost 200% in one year! Too many times I see investors shy away from solid investments due to the high price level and/or the large prior advance. I have added strong stocks to the MSW Index time and time again that are priced relatively high when compared to most stocks but not high when compared to what the market believes they are worth: (i.e.: AAPL, HANS, TS, WFMI, GOOG). CME may have looked high at $100, $200, $300 and then again at $400 but it continues to move higher. Learn to forget about actual price and start to focus on actual percentage gains.

Realize that 46% is the same whether a $123 stock increases to $179 or a $5 stock jumps to $7.30. By the way, take Sirius as an example, it has actually moved from $7.12 on December 2, 2005 to $5.08 today. Doing a quick newspaper search, you will see many analysts and talking heads hyping that stock prior to Howard Stern leaving the air. What happened? People were trying to buy speculation, not fundamentals and technicals. TS is up 46% since 12/2/05 while SIRI is down almost 30%.

Don’t buy into the idea that lower priced stocks move faster and can provide quicker routes to riches – THAT IS FALSE! They will most likely provide quicker routes to ruin! In the past week, I have actually heard someone say that they were buying more shares if SIRI broke below $5 and couldn’t wait to do so! Good money after bad has never made anyone a profit. Good Luck, I am happy with my money in BOT (even if it doesn’t work out because my sell rules will protect me from dropping 30% in my position).

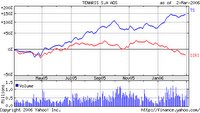

***Look at the chart comparison of a stock we recommended at $65 one year ago today and one that was priced near $6 per share with a TON of speculation! The high priced $65 stock is now trading above $180 in a strong up-trend and the low priced stock is now trading at $5 in a down-trend.

Here is a link to an article by another trader I respect: He talks about the reason why traders could afford Google last year (note: I started to cover the stock at $172 and cut it at $281 – I wasn’t in at the bottom or out at the top but I made a profit).

*Note that the article is from 2005 (not present day)

Yes, You can Afford Google

Piranha

[…] earnings go higher. They continue to make higher highs so never be afraid to buy stocks making new highs during bull markets or stocks that have a P/E ratio above the rest of the field. Luxury items […]