Making a Christmas List IV

Music, videos, photos and websites in 8GB and 16GB models starting at $299.

How could you go wrong? I want an iPod touch from Apple almost as bad as I wish I held the shares I once owned. I have actually owned shares in Apple several times including the present but have always sold during down turns (so much for timing the market with this superstar). Superstar is an understatement with this stock.

Of all the possible gifts on my list, the latest iPod touch rises to the top due to the affordability, the usability and the “cool” factor.

I do have one reservation: Why can’t a company such as Apple (AAPL) create a screen that will be easy on my eyes and allow me to transfer my subscription of Investor’s Business Daily (e-IBD) in PDF format so I can read it anywhere at any time?

Can someone please invent a portable PDF reader that is easy on the eyes (Amazon has a solid product but it does not allow the transfer of PDF documents). If anyone can do it, Apple will and they will do it right. This is why the company and the stock have been one of the great stories of this bull market.

Stock Analysis:

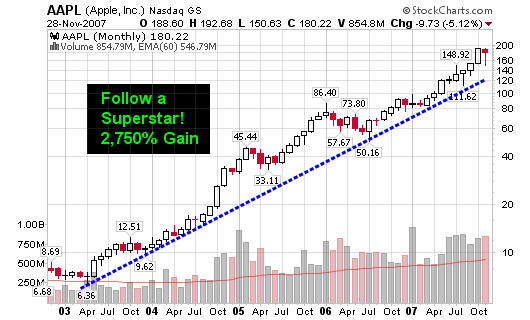

Words can’t describe what this first chart shows us!

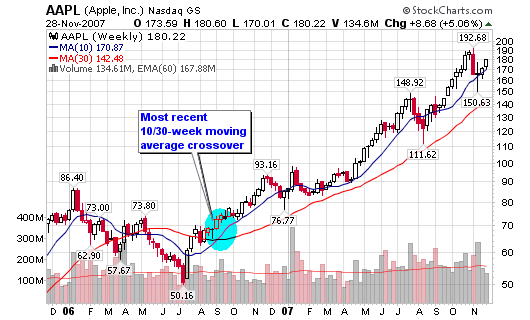

The second chart shows us that Apple successfully made a 10/30 week crossover to the upside in September 2006 above $70 per share, a 157% gain to date. The 50-day moving average has been the most recent support level but I would still use the 200-day moving average as the ultimate test of time. A new high and a move above $200 per share will be very bullish and a signal that this stock may have another run regardless of what the major indices do.

Rating: Hold (accumulate on dips) – trend is still higher.

Earnings:

FY 2005: $1.44

FY 2006: $2.27

FY 2007: $3.93

FY 2008: $5.00E (27.23% increase)

FY 2009: $6.23E

ROE: 28.52%

ROA: 16.43%

P/E Ratio: 44.46

PEG Ratio: 1.97

Institutional Analysis:

Total Institutions: 2,545

Money Market: 1,006

Mutual Fund: 1,459

Other: 80

Shares Held: 880.5 mil

Shares Held Previous Period: 849.6 mil

Shares Bought: 125.68 mil

Shares Sold: 94.78 mil

Value of Shares Bought: $19.2 Bil

Value of Shares Sold: $14.5 Bil

Prior coverage of Apple (AAPL) on the blog (stock screens not included):

1/17/07: All-Star Stock – Digesting Apple

Apple has been on my screens for 15 months and has been in my portfolio on two separate occasions over those 15 months. The most recent purchase was last summer as it broke into the $40 range. The first screen Apple made on MSW was on 10/24/04 at $23.71 (split adjusted from $47.41 – my actual entry area).

Since adding the stock back to the screens in July, Apple has gained over 100% and has moved up into the $60-$100 range. Overall, a long term holder from my initial coverage in October of 2004 would have a gain of 260%+. Two weeks ago, I said this to the community: “trend buyers could add shares now”. If they did, they are now up an additional 12% from the latest breakout point.

1/10/07: Apple Inc. is Still Green

What can I say; the apples keep getting greener! Apple Inc (the new name) unveiled its new iPhone and AppleTV yesterday as the stock was up over 8%.

1/13/05: Green “APPLE”s

Apple (AAPL) first showed up on my weekly screens on 10/24/04 at $47.41 (split adjusted 23.71). Since this time, Apple has made the daily and weekly screens numerous times.

The lesson of this blog is to pay attention to the charts, not the news. The charts showed us a buy 10 week ago and confirmed this buy several times since late October. Many people went out and bought Apple today based on the great news from yesterday (Apple shattered estimates).

10/25/04 – 10/29/04: $52.40

11/22/04 – 11/26/04: $64.55

11/29/04 – 12/03/04: $62.68

12/06/04 – 12/10/04: $65.15

01/03/05 – 01/07/05: $69.25

The most recent daily post was on 01/05/05 at $64.50.

Christmas List Series:

- Part I: My Lexus by Toyota Motor Corp (TM)

- Part II: A Garmin (GRMN) for my Lexus

- Part III: Suit Time at the Men’s Warehouse (MW)

Next up in this 5-part Series:

- Part V: A Blackberry Pearl from Research in Motion (RIMM), using the Verizon Wireless (VZ) Network

Hi Chris!

My comments is not related with this post. I just want to know your position about the market right now. Are you in cash waiting for a follow through day or did you go a bit ahead of time starting to buy now? What are your best pattern up to date? What do you think of OSIP and FLS?

Thanks!

I love Apple, no, not in a Mac Nazi sort of way, I just like their products. Not so much because they are cool, but for the amount of trouble free working hours I get out of each machine I own. I admit it took a while, I used to hate them before OSX Tiger came out. But I tried a friend’s for a few days and was hooked. I use both XP and Leopard everyday, and its really tough during the XP part of my day! My laptop is nearly 2 years old, and feels every bit as fast as when I bought it, I see no need for a new one anytime soon. I too have traded in and out of AAPL for years and its been kind to me, affording me all my Apple gear. One day the trend may end, but for now, Ill keep pointing my Mighty Mouse cursor to the Long side…

While we are on the subject of Tech, what do you think about the Japanese Apple– Nintendo(NTDOY)? I own a Wii and a DS which I think are great products, and the stock has been killing it for a while now, a real nice run. It seems like its filling its latest gap and could head to 200 if it can break out again.

Geez…to early in the morning for me…100! not 200! sorry Chris.

though you never know with these things….=)

Ty,

I agree about the Apple products. I don’t know anything about the Nintendo stocks so I will take a look. My sister loves here Wii along with mnay of my friends (I guess I prefer online poker versus video games).

Michael,

I am still long the postions I currently hold (AAPL, GOOG, EDU, JASO, MA, BX). I no longer hold shares in SNCR, VMW, BIDU, PTR and GTLS.

Some of my current holdings have been trimmed along the way and MA was once trimmed completely but was added back at a smaller size.

I will have to look at the stocks you mention.

hey chris im thinking about accumulating more shares of aapl if it comes back underneath 173 again. Once it touches the 10 week ma again, do you think it has another shot at testing the all time high and breaking out before the new year?