I have been using Twitter and StockTwits for approximately two months and have highlighted 18 different stocks. Of the 18 stocks, 15 are currently showing a gain and 3 are showing a loss for an average gain of 20% per position. I only analyze stocks that I am about to buy/sell or would possibly buy/sell. I don’t talk about any old stock for the sake of posting tweets and wasting people’s time.

The average gain of the stocks showing a profit is 26%.

The average loss of the stocks showing a loss is 11% (-5%, -8% and -21%).

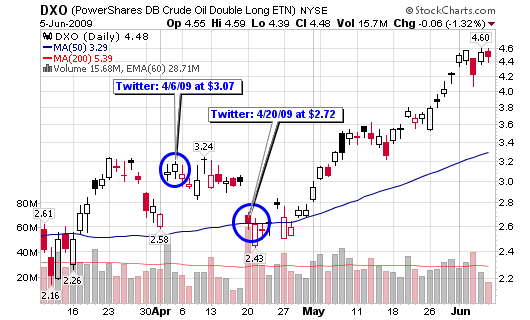

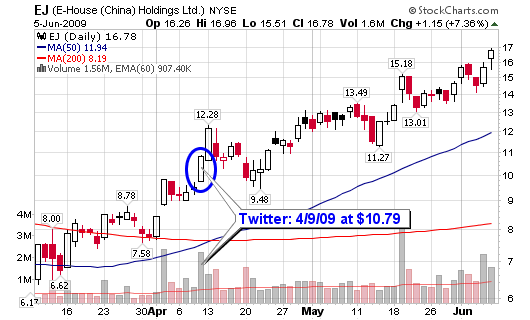

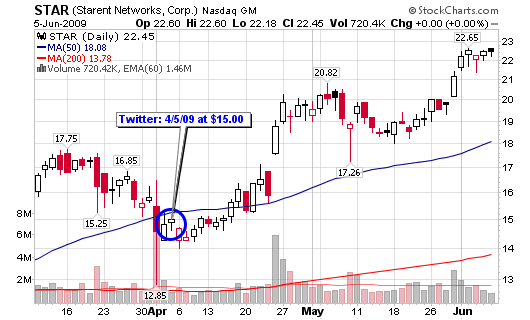

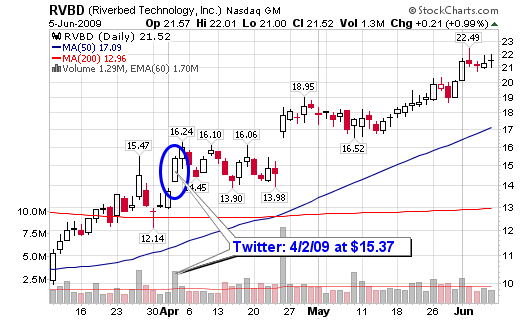

The top performing position is DXO, currently up 65% with a peak gain above 70%. Following DXO is EJ at 56%, STAR at 50%, RVBD at 40%, FRPT at 32%, ARST at 26% and V & VMW tied at 25%.

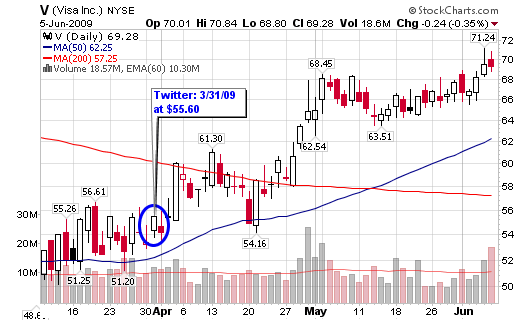

Visa (V) has appeared the most with a total of eight mentions (I may be biased since it’s my largest personal holding). DXO has also been an active play of mine since 2008 so it has been the second most popular ticker in my tweets, appearing five times over the past two months (DXO first appeared on this blog last November as a speculative oil play).

I would like to emphasize that the stock down 21% (APEI) would have been cut for a smaller loss using simple money management tools but for purposes of this update, we’ll assume everything is still being held.

Below is the list of stocks highlighted on my Twitter account, listed in date order (starting on March 31, 2009):

- HTS: +7%, $26.15 from $24.35 on 3/31/09

- V: +25%, $69.28 from $55.60 on 3/31/09

- VMW: +25%, 32.59 from $26.12 on 4/1/09

- RVBD: +40%, $21.52 from $15.37 on 4/2/09

- STAR: +50%, $22.45 from $15.00 on 4/5/09

- CXO: +14%, $31.90 from $27.96 on 4/5/09

- DXO: +65%, $4.48 from $2.72 on 4/20/09 (1st posted on 4/6/09 at $3.07)

- EJ: +56%, $16.78 from $10.79 on 4/9/08

- ARST: +26%, $18.19 from $14.46 on 4/9/09

- FRPT: +32%, $9.36 from $7.09 on 4/13/09

- WMZ: +12%, $19.85 from $17.70 on 4/14/09

- CTCT: +10%, $20.14 from $18.36 on 4/20/09

- TNDM: +15%, $30.78 from $26.81 on 4/20/09

- CFL: +11%, $30.60 from $27.50 on 4/26/09

- PAR: +3%, $11.27 from $10.94 on 6/2/09

- APEI: -21%, $34.56 from $44.00 on 4/2/09

- MDAS: -5%, $15.90 from $16.79 on 4/23/09

- MELI: -8%, $23.62 from $25.60 on 5/12/09

If you haven’t joined already, take the few seconds to follow me on Twitter as the bulk of my analysis appears there weekly, if not nightly.

P.S. – the bragging title of this post probably signals a short term top in the market! As I wrote yesterday:

“The main purpose of the stock market is to make fools of as many men as possible.” – Bernard Baruch

hey chris, have enjoyed following your tweets, congrats on the nice plays. We’ve noted a ton of prominent hedge funds in V (and MA as well) as they are liking the duopoly in the payment processing model. Not to mention, the setups in the charts have been solid as well. Here’s the hedge funds we’ve covered: http://www.marketfolly.com/2009/05/john-griffins-blue-ridge-capital-likes.html

Keep up the great stuff.

Jay

@marketfolly

hey chris,

Before the market crash i would go in 20k-30k with an 80k account per trade via canslim, and just hold it for a few days for that breakout bang, and when the market was good, this worked out wonderfully; i could just replace my batch of stocks every 1-2 days and replace them with new ones and do the same thing over and over.

However, with more market uncertainty i think it would make more sense for me to do what you do, as well as the original canslim method from the more aggressive style i was going with.

I read your post about position sizing, for example risking 1-2% of total capital with 7-8% stop per trade (sometimes less, depending on trade)

However, my question is, if i was to do this, each of my position would be about $11,000 investment per trade.

so say i did my research and filtering, and came up with 7 good stocks to trade and i entered into them now, that would mean that from now to maybe 2-3 months from now, i wont have any money to enter any other stock, and i could not exit out of my existing stocks because i need them to run their course (unless something dramatic happens)so even if better market condition and stocks showed up during this time, i will not be able to do anything about them.

Have you ever ran into this problem?

Anyway, would love to hear your thought on this.

-kind regards

mike

Mike,

With 80k and an average stop of 10%, yes, you will have positions averaging $10-$12k each. A tweak up or down with the stop will increase or decrease the position size. A 2% risk will allow positions to reach the $20k area depending on the stop.

The problem does arise when you have multiple candidates to buy. So, you enter the best and keep them unless a better opportunity comes along. There’s only so much money in an account and risk one can handle. You could leverage yourself but I wouldn’t recommend that in this market.

Hope this helps: see the simple position sizing spreadsheet if you haven’t already:

http://www.chrisperruna.com/wp-content/calcs/position_size_with_stops.xls

Chris,

I’m about to have my 1st kid in September and I was curious to find out if being a dad makes you more focused as a trader?

Travis,

It does. I have cut out all the excessive reading and unnecessary research and went back to basics. What a relief as I was clouding my mind with too much junk. It’s tough keeping up this blog – that’s why I am more active on twitter.

We detected a market top around 2 weeks ago.

I noticed our analysis just turned neutral from strong bearish. What do you think?

http://www.traderbots.com/stocks/Stocks.aspx

Ok, thanks for responding!

I had been holding off on Twitter because I thought it was going to be a distraction. I’ll have to check it out.