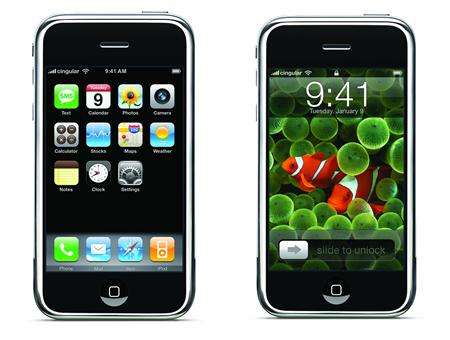

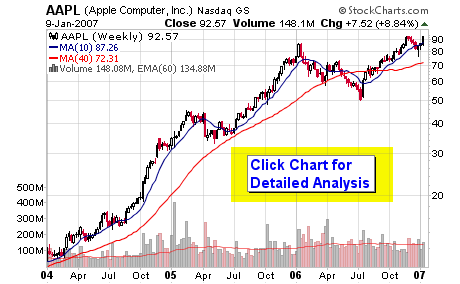

What can I say; the apples keep getting greener! Apple Inc (the new name) unveiled its new iPhone and AppleTV yesterday as the stock was up over 8%. As you all probably know by now, it’s more than just an 8 gigabyte iPod mobile phone with a touch-screen. It looks great; sharp and sleek with internet capabilities that have me salivating. One problem for me though: I don’t use Cingular and I am not changing my carrier because my service has been excellent for five straight years so I’ll stick with my razor and traditional iPod for now.

I have not owned Apple shares in a long time but it was a stock that I owned on multiple occasions in late 2004 and throughout much of 2005. I finally sold my shares in late 2005 and wrote this to all MSW members in early 2006:

Saturday, February 4, 2006 – MSW Index:

APPL – 71.85, Apple is still struggling below the moving average but has not violated the major support level of $70. It will be removed from the MSW Index if it breaks the $70 support. Rating: Hold (sell below $70 – buy if it holds)

Monday, February 6, 2006 – MSW Daily Screen:

Apple Computer (AAPL) has been cut from the MSW Index as it violated the support line on volume 100% larger than the 50-d m.a. with a 6.33% drop. I hope many of you also cut your positions when the red flags started to pile up. If not, I strongly suggest cutting the stock and locking in profits before the stock drops further.

NOTE: the stock dropped 30% over the next five months and took more than eight months to break even but it did. It is now almost 30% higher than the violation date back in early 2006. I would be showing a larger profit if I were a buy-and-hold investor but maybe I would have never bought LVS in April without this Apple cash. I just can’t watch a position go against me no matter the long term results. I don’t buy and hold – maybe some day!

One of my earliest blog posts was about Apple back on January 13, 2005 and I titled the post “Green Apples”.

I followed up that post with one titled: All-Star Stock – Digesting Apple on January 17, 2006.

It’s a great company and a great stock, let’s see where it goes.

Disclosure – I do not own shares in Apple and I don’t plan to buy in the near future.

The tip-off for AAPL was Dec.27. The pattern from late November to Dec.27 was a classic drift & spike pattern. You buy the stock once it takes out the spike day high which was Dec.29. I concede it gapped on Dec.29, but as a rule you can buy the gap if the pattern is perfect. In the case of AAPL it was a perfect drift & spike pattern.

I have found this pattern to be a high probability situation to get into a leading stock that trends downward for a while.

I bought Apple back in July when it gapped out of its downtrend, at 60.63. I feel really proud of myself for that buy. I took some partial profits when it retraced a portion of its gains. It retraced 30% (from 91 to 81) so I sold almost half of my position, because that’s what my rules say to do in order to preserve gains. But, I really wanted to buy more, the pullback was an opportunity to load up.

I still plan to hold onto it for a while. Maybe instead of selling next time, I’ll buy puts instead. That might be a plan for cashing in on pullbacks.