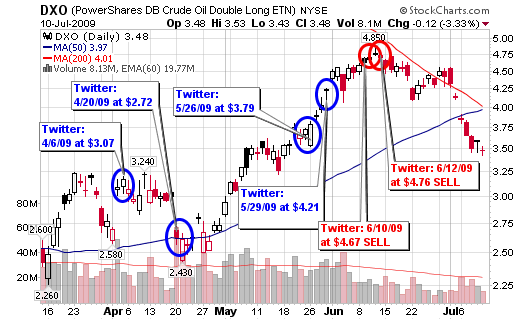

I figured I would recap my last 100 tweets to those of you that still check into this blog but don’t follow me on twitter. Please, check me out on twitter as I do most of my writing and thoughts over there as the new family life prevents me from writing intense, heavily researched stock blog posts. I am not in the business of writing short crappy blog posts so I focus my time on actionable ideas and education on twitter. I plan to one day return to more consistent writing on the blog. Until that day, follow my tweets to stay in touch with my thoughts on the market (1,200 other people already follow).

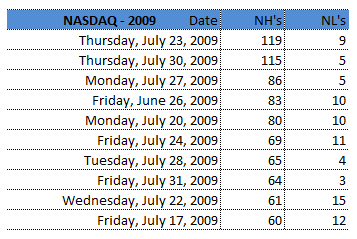

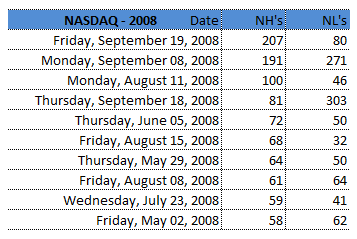

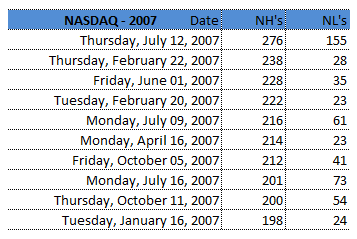

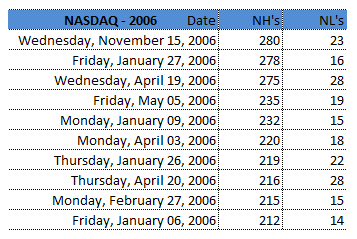

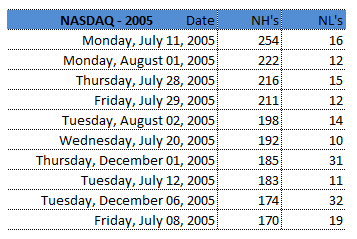

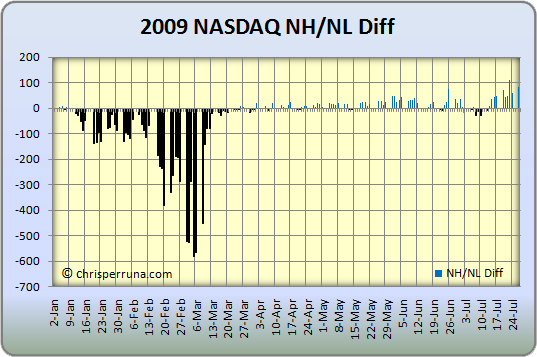

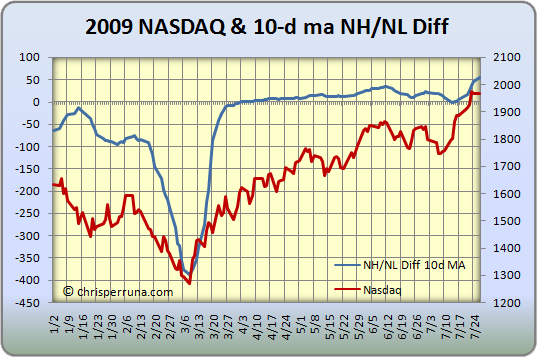

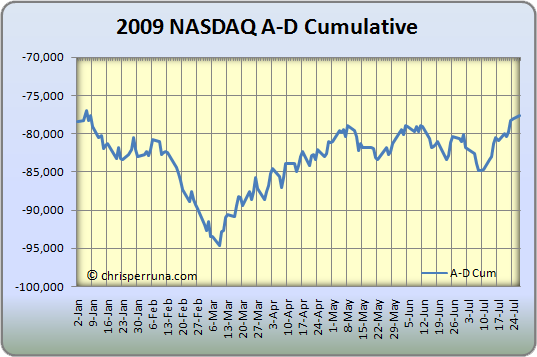

If you can take anything away from my recent tweets, focus on the message of the following ten tweets, reference the bold type (they all show caution and skepticism in the market based on the lack of individual leaders). New Highs have been reaching levels not seen in years but they are still far below the levels necessary for a “true bull market”, one that will be sustainable.

1. $V – hit new highs day after day on volume less than half the ave. Gets rocked today on above ave vol. Clear sign of market – told ya! $$8:47 PM Sep 25th from web

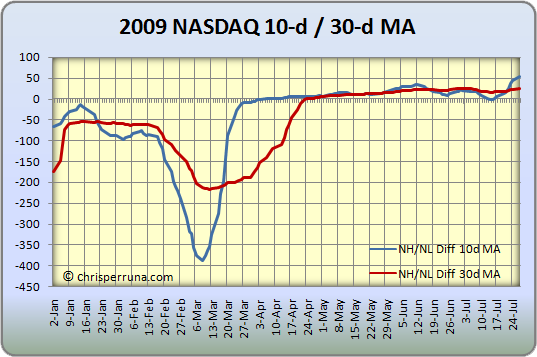

3. NASDAQ: 135 NH’s today, the most in 2009 but we had more declining issues than advancers. Still suspect market $$9:13 PM Sep 17th from web

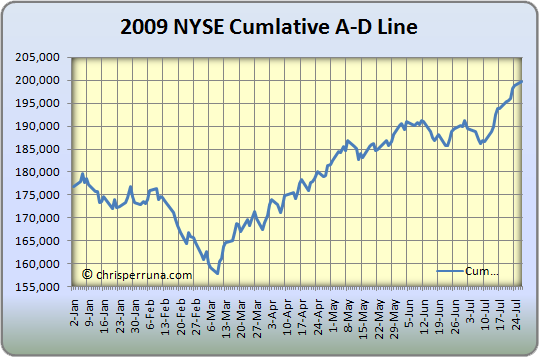

7. Markets near new highs but individual stocks are not making NH’s! Subtle divergence to watch. Adv-Dec is not making NH’ss either $$10:54 PM Sep 14th from web

8. $V – 72.87, another new high, more below ave volume.8:48 PM Sep 14th from web

17. $V – 72.31, hits a 52-wk NH but vol still concerns me. Holding but thoughts of cashing in creeping into mind. Up 30% since March (10 tweets)8:23 PM Sep 10th from web

35. Is the head forming in the market for a Head-and-Shoulders pattern ($SPX & $COMPQ)? It’s early but maybe…Time for bed! $$12:28 AM Aug 30th from web

47. The buy isn’t there yet but the inverse ETF’s can be a nice tool if the market drops, especially NASDAQ: $PSQ, $SH, $DOG, $QID11:39 AM Aug 19th from web

48. $GS – $160.48, has the same short term topping pattern as the NASDAQ on the weekly candlestick charts9:37 PM Aug 18th from web

49. @zaiteku However, the NASDAQ is weak. NH’s weak. Short term topping pattern & triple bottom breakdown. 200d is a nice support level $$9:21 PM Aug 18th from web in reply to zaiteku

56. Confusing market? “Keep cash if enough issues w/ such promise cannot be found or if the investment per issue becomes unwieldy” Loeb $$11:32 AM Aug 15th from web

*********************

See below for the complete list of my most recent tweets (100 total tweets – all dated and reproduced exactly as they appear on twitter).

Connect with Me