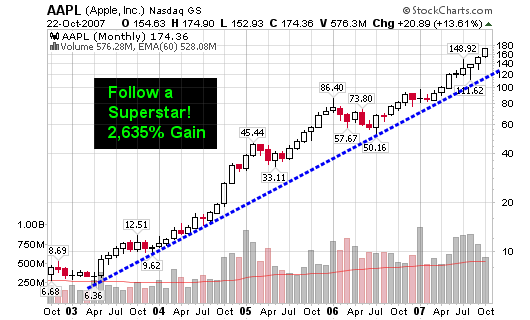

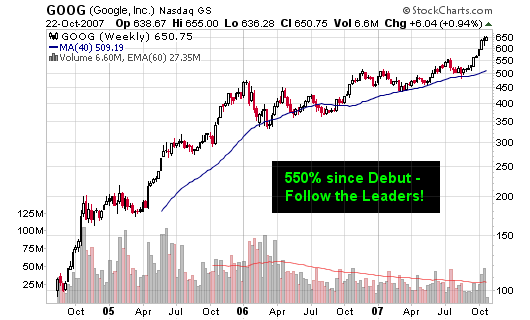

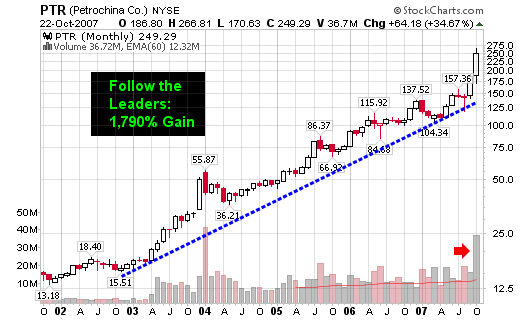

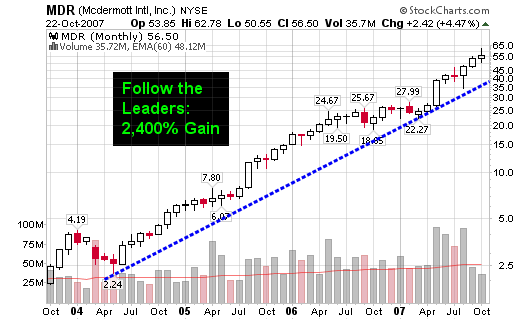

Watch the action among these leaders to truly gauge where the market is headed. Step back and view their long term charts so you don’t get caught up in the day to day MINOR movements!

Seriously, step back and throw the charts on the floor or hang them on a wall across the room and you will clearly see the trends. These stocks have been leading the market higher and will give the FIRST clues of a market looking to go lower! We did have our second major distribution day last Friday and fourth overall but these stocks will tell the ultimate story!

The major Superstars include AAPL, GOOG, PTR & MDR

The minor or more recent Superstars include BIDU, FSLR, GRMN, EDU and others on the blog. See my stocks category to find the leaders of 2007.

Connect with Me